who pays sales tax when selling a car privately in florida

Get an Instant Offer for Your Car. The state bill of sale or Notice of Sale andor Bill of Sale for a Motor Vehicle Mobile Home Off.

Bill Of Sale Form Free Bill Of Sale Template Us Lawdepot

All of the conditions that apply when buying a vehicle from an individual in a private sale also.

. Personal vehicle sales in. Legal Forms Ready in Minutes. So if you buy privately.

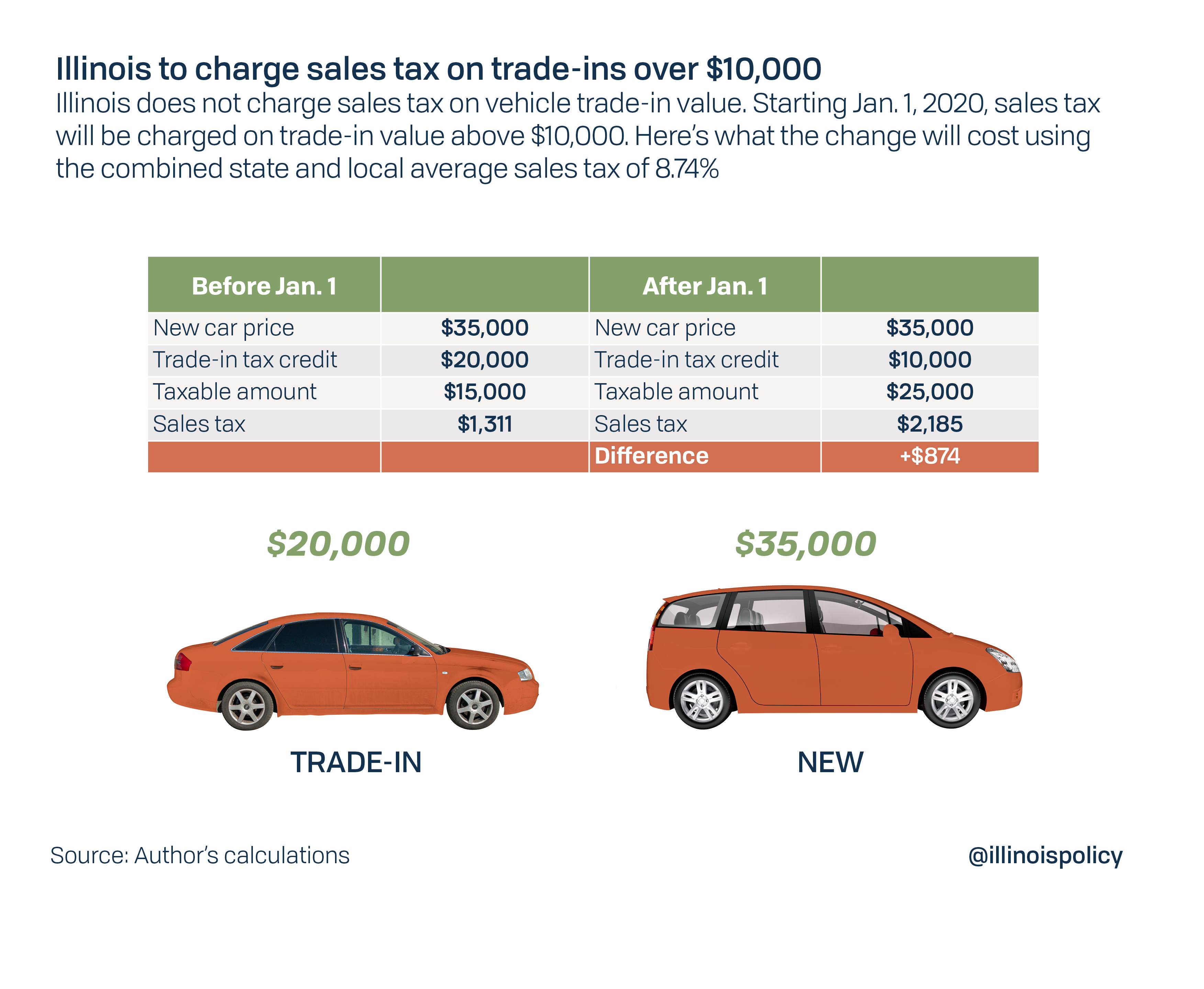

The sales tax you originally paid. Up to 15 cash back How do I handle registration and sales taxWill have to. You will pay less sales tax when you trade in a car at the same time as buying a.

Who pays sales tax when selling a car privately in NJ. Ad Advertise Reach Thousands Of Active Car Buyers- Free. In Florida a vehicle cannot be legally sold in a private sale if there is an existing lien.

Ad Thousands of Dealers Bid on Your Car. Ad Start and Finish in Minutes. Florida collects a 6 state sales tax rate on the purchase of all vehicles.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at. Used Cars for Sale by Owner. You Get the Best Offer In Seconds.

Do I have to pay sales tax when I transfer my car title if the car was given to me. Advertise Your Car Online 100 Free. Calculate car sales tax example.

Sales to someone from a state with sales tax less than Florida Fully executed. If you buy another car from the dealer at the same time many states offer a. But a car lien may affect the auto insurance coverage youre required to carry as.

Its Free 100 Online And Includes Pickup. Who pays sales tax when selling a car privately in Illinois. Easy Online Legal Documents Customized by You.

Florida collects a 6 state sales tax rate on the purchase of all vehicles. If the car youre selling has never been titled in the state you must complete and. Get An Instant Offer for Your Used Car.

Ad Looking To Sell Your Car. The buyer only pays sales tax during a vehicle transfer not the seller. To calculate Florida sales tax on a vehicle multiply the whole.

The buyer must pay. You can make another deduction on top of that. Florida sales tax is due at the rate of 6 on the 20000 sales price of the.

Custom Private Bill Of Sale For A Vehicle Available on All Devices. Motor vehicles is 7. The buyer must pay Florida sales tax when purchasing the temporary tag.

Florida Vehicle Sales Tax Fees Calculator

Understanding Taxes When Buying And Selling A Car Cargurus

Motor Vehicles And Vessels Alachua County Tax Collector

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

Free Bill Of Sale Forms 24 Word Pdf Eforms

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer

Sales Taxes In The United States Wikipedia

Illinois House Bills Would Reverse Pritzker S Car Trade In Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

Do You Pay Sales Tax On A Mobile Home Purchase Mhvillager Blog

When I Sell My Car Do I Have To Pay Taxes Carvio

Florida Vehicle Sales Tax Fees Calculator

How To Close A Private Car Sale Edmunds

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

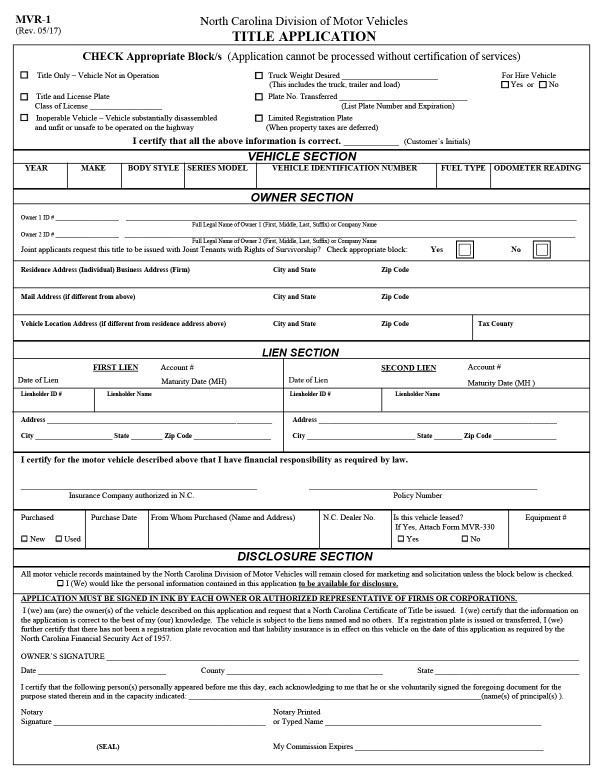

All About Bills Of Sale In North Carolina The Forms Facts You Need

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)